A secured loan is a form of debt in which the borrower pledges some asset ie a car a house as collateral. Since the standards of lending do vary from one state to another specifying the place the loan originated from will clarify its legal context as well as the explicit provisions that might carry on the loaning contract.

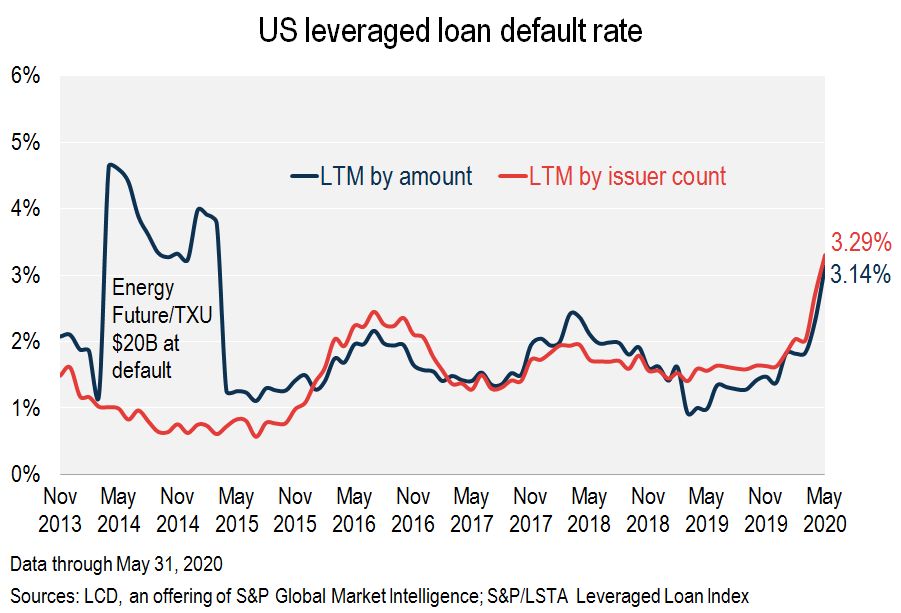

Us Loan Default Rate Tops Historical Average Finally Led By Retail Telecom S P Global Market Intelligence

Car Loan Default What When And How The Economic Times

Debt Default Definition Consequences And How To Avoid

As cars have gotten more expensive however loans with terms of 60 to 72 months or even longer are widely available.

Car loan unpaid defaults. Post which cancellation will be treated as foreclosure. A credit report is a file that logs all the times a bank lender telco utility or other service that provides credit has approved you for a loan. Car loan car is security hire purchase or rent to buy eg.

Simply put a loan enters default when the borrower fails to pay the lender per the terms in the initial loan agreement. The seven-year rule is based on when the delinquency occurred. When an auto loan defaults the lender or car dealer is usually able to seize or repossess the car to pay for the outstanding debt.

1 of the loan amount interest from date of disbursal till receipt of cancellation request Cancellation request to be received within 30 days of loan booking date or 1st EMI presentation date whichever is earlier. He also set up our insurance for the new vehicle as an added bonus. It also shows any defaults on that record.

The 105000-square-foot home overlooking Los Angeles has seven pools a 50-car garage a 10000-bottle wine cellar and even its own nightclub. The loan term is the length of the auto loan and its typically expressed as a number of months. You need to contact your secured creditors to discuss your intentions with the debt.

Dont stress Zoom Car Loans are experts in this field. This will continue to be charged on the outstanding balance until fully paid. Cosigning a car loan means adding your name to a borrowers auto loan application.

The term payday in payday loan refers to when a borrower writes a postdated check to the lender for the payday salary but receives part of that payday sum in immediate cash from the lender. But your loan term plays a. A family member or friend may ask you to co-sign a loan for themto get a house buy a car obtain a credit card or rent an apartmentand you agree.

A mortgage loan is a very common type of loan used by many individuals to purchase residential property. Furniture or electronics as security. As per actuals Physical Repayment Schedule.

Because the value of a car depreciates over time its likely that the current value of a repossessed car isnt enough to cover the outstanding balance of a defaulted loan. A lender can use a Loan Agreement in court to enforce repayment if the borrower does not uphold their end of the agreement. Get low rate car loan fast approval from the comfort of your home.

Dear BAJ Late payments remain on the credit report for seven years. For a free quote Call 1300 358 358. Portland Cement defaults on loan cuts staff by 78pc Friday November 12 2021 East African Portland Cement shareholders during the annual general.

More defaults mean a. We then work on your behalf to compare the options available and secure you finance approval for a new. Bad credit home loans assist you to secure a loan to purchase a home or renovate a property or consolidate debts defaults judgements etc back into your mortgage via a re-finance.

Would highly recommend Lily Mackenzie. Comparison rates range from 245-518pa Pepper EasyNear Prime home loan variable interest rates range from 319-715pa. Our car loan was approved and settled within 3 days.

Does having a cosigner lower car payments. The lender usually a financial institution is given security a lien on the title to the property until the mortgage is paid off in full. Hi sir kindly help me I take T permit car loan i had paid 17 emi 15605 and paid 80000 down payment and last six month my financial condition is not good than i fail to pay emi than company said give a car and i give a car last 3 month back and company sell the car without intimetion of Rs-240000.

Loan terms of 36 to 48 months were once the most common lengths. Even if you have one of the worst credit files been behind on loan payments and even behind on your mortgage we may be able to assist It all comes back to your affordability and the amount of equity in your. Chances are if you have defaults a bad credit history or numerous inquiries your bank or financial institution will decline you for a car loan.

The interest rate on the loan is 10 per annum based on diminishing principal balance. Loan defaults can weigh down the entire country. Calculate your payments with our car loan calculator.

I was able to contact Aaron direct and he provided fast and reliable guidance and service. This is handy shorthand to tell lenders to lend to you or not. They lost their best client by sheer default.

We take the time to learn about your previous credit history and current circumstances. The time frame before default kicks in can differ from one loan to another. Whether the entire account will be deleted is determined by whether you brought the account current after the missed payment.

A Loan Agreement is a legal contract between a lender and borrower outlining the terms of a loan. If the borrower defaults on the loan repayment then falls to the cosigner. A payday loan also called a payday advance salary loan payroll loan small dollar loan short term or cash advance loan is a short-term unsecured loan often characterized by high interest rates.

If youre unable to maintain the payments you may be able to surrender the goods. Default definition failure to act. A cosigner for your car loan improves your chances of receiving a lower interest rate and therefore lower payments.

However repossession is a last resort move for most auto lenders. Comparison rates range from 348-742pa and Pepper AdvantageSpecialist home loan variable interest rates range from 429-749pa. Almost 5 million student loans have gone unpaid for a significant amount of time.

In cases where the loan defaults the unpaid amount will be deducted from benefits claimed by the member. Best cheap car insurance. For a limited time only Pepper EssentialPrime home loan variable interest rates range from 225-499pa.

If you miss a payment or two you may incur fees and your loan may be designated as delinquent but typically you can return to good standing by making a full payment within a reasonable amount of. Using a loan agreement template the lender and borrower can agree on the loan amount interest and repayment schedule. The personal loan guarantee form outlines the loan balance in full and the specific state in which the loan was granted.

Car Loan Term. In an ideal situation the person you co-signed for makes all the payments on time abides by the agreement and the loan is paid off with no hiccups.

Subprime Borrowers Aren T Paying Car Loans As Millions Still Struggle

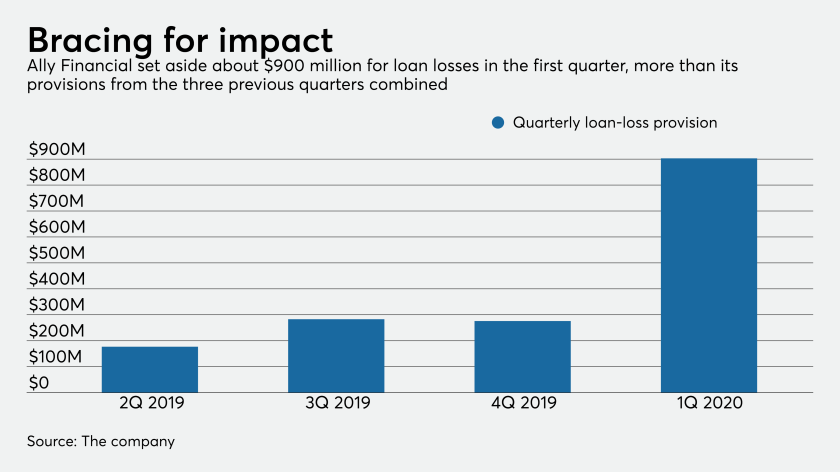

Ally Girds For Surge In Auto Loan Defaults American Banker

What Can Loan Level Data Reveal About Us Auto Loan Abs Msci

Is Psbank Auto Loan The Best Car Loan To Get Your Dream Ride

Car Loan Default All You Need To Know Bankbazaar The Definitive Word On Personal Finance Car Loan Default All You Need To Know

Getting A Car Loan With Unpaid Defaults

Car Loan Default What When And How Rediff Com Business

What Can Loan Level Data Reveal About Us Auto Loan Abs Msci